Beyond the E-cash

A non-physical value of a financial asset, based on the idea of trust, in the modern sociopath society would only lead to one result - an eventual crash. The article could be stopped here. However, we would like to mark out certain things on cryptocurrency before a wrap up.

The idea is too futuristic?

An idea of the 'free world without any banks, or central regulation' sounds more like a country with no police or firefighters. But:

If you eliminate all firefighters, the fire will go away?

Any digital currency has certain spaces to fill out before turning into a feasible tool for a mundane use. The most doubtful questions concerning the crypto are:

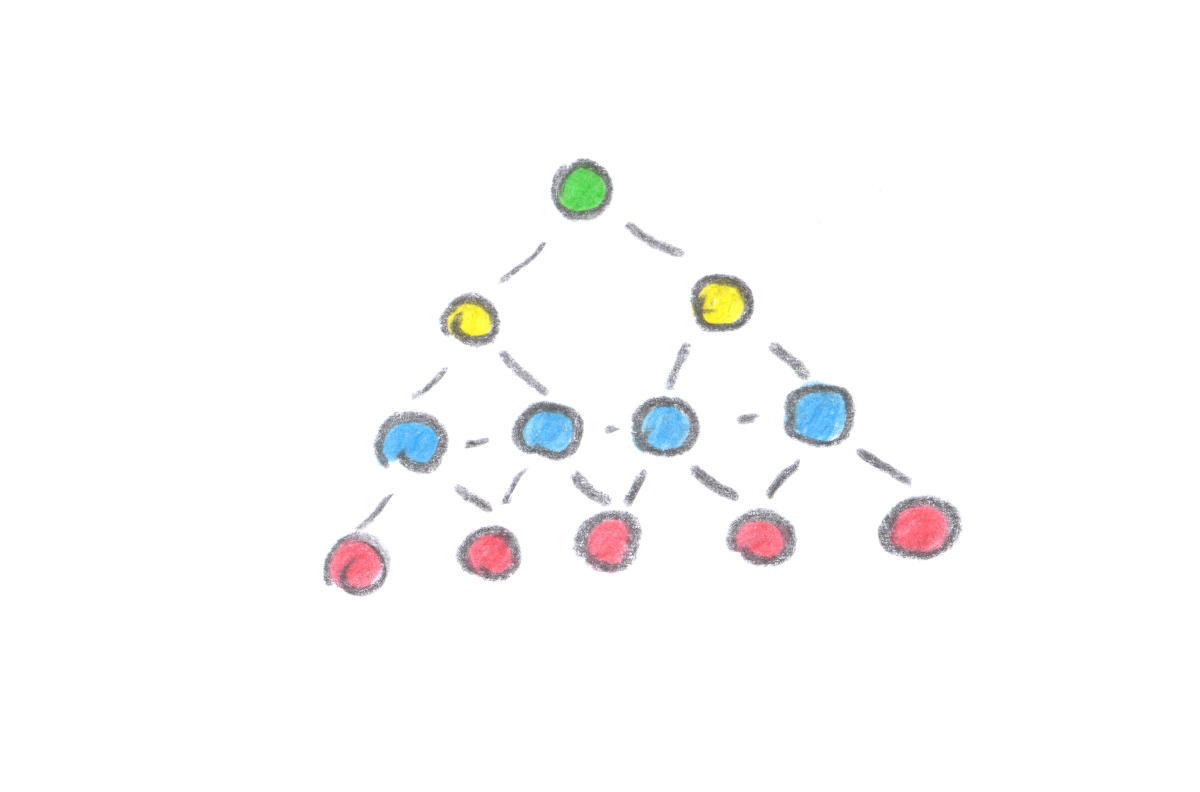

- cryptocurrencies are centralized in hands of ledger/exchange database owners?

- encrypted data could be changed (decrypted) by those, who originally encrypted it?

- cryptocurrencies are centralized in hands of mining corporations?

- cryptocurrencies are not backed by any traditional commodity (gold, silver, bronze, etc, though they state so, such statements are reliant on trust or assumption and are not backed by any legal regulation, nor by a solid proof)

- no cash equivalent for an alternative

- the crypto issue is not regulated by central banks or the government (any top level owner of a cryptocurrency company could abuse, violate its own terms, 'printing out' cryptos unregulated)

- prone failing in accounting frauds, earnings and reports misstatement, embezzlement or financial pyramids

- harder to audit and litigate

- security and investment insurance issues

- an easy funnel for money laundering, drug cartels, etc. Simple people, who need privacy could still use cash instead

- too many new cryptocurrencies with penny values

- idea-driven? Community-driven? How about production-driven?

We don't get it

In the world of staggering financial inequality people tend no longer to believe in easy returns. The futuristic world, such as Stratius, where financial mining is ubiquitous and arbitrated, possible only in the age of the advanced AI, where androids literally control judicial and financial aspects of cryptocurrencies. In hands of humans, it will stay the same.

Security issues

If social interaction change in time and the government no longer plays a central role, then the cryptocurrency becomes somewhat required - at least hypothetically. Still, there is the other political dilemma of such an adaptation - the neighbouring countries.

How would the crypto transpire to third or second world countries and how it would protect the advanced nations against the malicious use of such an anonymized currency? Authoritarian leaders never allow deregulation or renunciation of their own power.

Production value?

How would it change the current labour law, production lines, business operations? Political implications of money laundering, offshore zones, drug and human trafficking, terrorism sponsorship, etc? A nearly monopoly of Bitcoin mining, etc.

We are not insisting that the government is an ideal institution in the free world (though it's not even free for the most parts of it), but at least, the government has a track-record behind it. Legal precedents and regulations that work, one way or the other.

The government still enacted by humans, who could be held accountable for their crimes. Could the same be said about the crypto regulators?

Would cryptocurrency create negligence and anarchy? And the most important, would it even hold for any production value, for being merely a digital medium? It all sounds dubious to this point, but the search goes on. We see some artificial demand for the crypto, flimsy and hype driven spikes even for Bitcoin. How serious the crypto is - only time will tell.